Milleproroghe 2026: rinviata la Riforma Fiscale, prorogati Bonus Assunzioni e assemblee online

Il Consiglio dei Ministri ha approvato l’11 dicembre 2025 il cosiddetto Decreto Milleproroghe (D.L. termini normativi) che interviene su scadenze imminenti il cui mancato rispetto o rinnovo potrebbe c

Termini di decadenza dell’accertamento fiscale al 31 dicembre 2025

Il termine di decadenza ordinario per l’accertamento delle imposte sui redditi è individuato dall’art. 43, D.P.R. n. 600/73 (al quale rimanda l’art. 25 del D.Lgs. n. 446/97 per l’IRAP); per l’IVA, la

Contributo di 500 euro mensili per Under 35 che avviano nuove imprese in settori strategici

Vi segnaliamo un’importante opportunità introdotta dal Decreto Coesione e recentemente resa operativa dall’INPS con la Circolare n. 148 del 28 novembre 2025. Si tratta di un incentivo economico volto

See archive

02 Gennaio - Inps Ex-ENPALS: denuncia contributiva mensile unificata

Entro questo termine le aziende dei settori dello spettacolo e dello sport sono tenute a presentare la denuncia mensile unificata delle somme dovute e versate relative al mese precedente, dei lavorato

02 Gennaio - Dichiarazione dei redditi presentata dagli eredi

Entro questo termine gli eredi delle persone decedute tra il 1 marzo 2026 e il 30 giugno 2026 devono provvedere alla presentazione in formato cartaceo, presso gli uffici postali, della dichiarazione d

02 Gennaio - Locazioni: imposta di registro

Versamento, per i titolari di contratti di locazione e affitto che non hanno optato per il regime della cedolare secca, dell'imposta di registro sui contratti di locazione e affitto stipulati in data

See archive

News and press

News and press

CESSAZIONE ANAGRAFE DELLE ONLUS: ISCRIZIONE AL RUNTS ENTRO IL 31 MARZO 2026

Il Ministero del Lavoro e delle Politiche Sociali ricorda che, dal 1° gennaio 2026, l?"Anagrafe unica delle Onlus sarà soppressa.Le Onlus iscritte nell?"Anagrafe che intendono continuare a operare com

ESTINZIONE SOCIETà: IL DIFFERIMENTO QUINQUENNALE OPERA INDIPENDENTEMENTE DALLA NATURA DELLA CANCELLAZIONE

Con la sentenza n. 29070 del 4 novembre 2025, la Corte di Cassazione, Sezione V Civile, ha chiarito che l?"articolo 28, comma 4, del Dlgs n. 175/2014, che differisce di cinque anni l?"efficacia dell?"

See archive

Request information

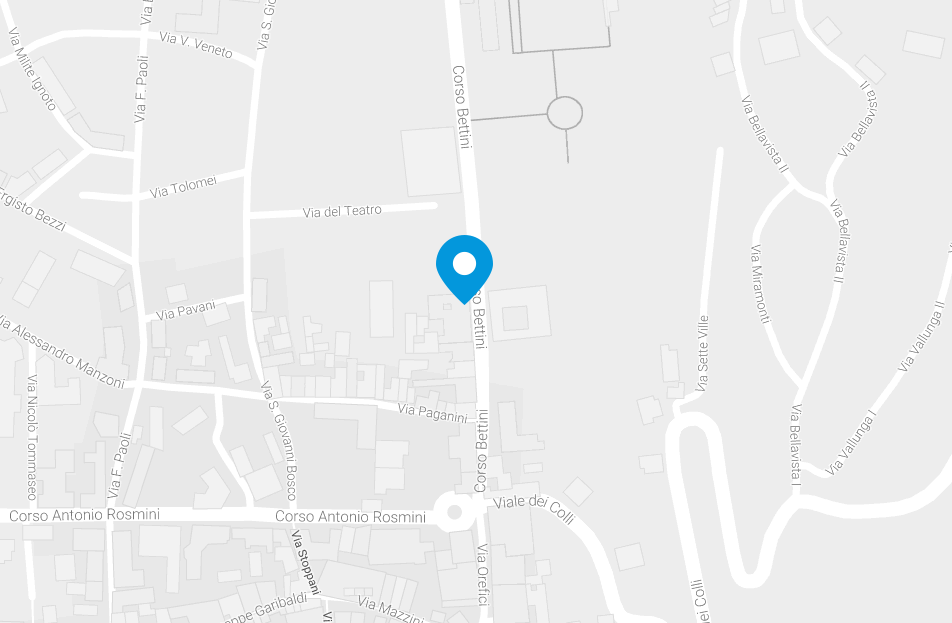

Studio Dorighelli

Corso Bettini, 58

38068 Rovereto (TN)

Tel: (+39) 0464 434955

Fax: (+39) 0464 316095

info@studiodorighelli.it